Project Overview

Our client is a leading Middle East–based fintech enterprise offering open-API, cloud-native, and modular digital banking platforms that help banks, fintech's, and financial institutions modernize their operations. Their flagship Banking and Financial System (BFS) is an API-first, composable core banking suite that supports both conventional and Islamic banking, enabling clients to launch new products rapidly, integrate with legacy systems, and deliver customer-centric digital services. Recognized for innovation and scalability, the firm has received multiple accolades, including “Best Islamic Finance Solutions Provider” at the Global Islamic Finance Awards, and continues to shape the next generation of digital banking across emerging markets.

What is the Banking and Financial System?

What is the Banking and Financial System?

Banking and Financial System is a flagship digital core banking solution, designed with an API-first, cloud-native, and modular architecture that empowers financial institutions to innovate quickly and scale efficiently. It serves both conventional and Islamic banking needs, giving banks and fintech's the flexibility to launch new products, manage operations seamlessly, and integrate with third-party systems without friction.

- API-first and cloud-native for easy integration and scalability.

- Supports both conventional and Islamic banking operations.

- Wide range of functionalities including lending, deposits, CASA accounts, and payments.

- Modular & composable architecture banks can add or remove modules as needed.

- Seamless integration with legacy systems through open APIs.

- Scalable, secure, and compliant platform designed for rapid digital transformation.

Key Features of Banking and Financial System:

Challenges We Faced

Despite using Odoo CRM and their in-house BFS platform, the client faced severe disconnects between both systems:

Manual Loan Processing:

- Lead-to-loan approvals were handled manually, causing delays and compliance risks.

Fragmented Data:

- Customer, asset, and budget information were duplicated across systems.

Budget Misalignment:

- Budgets defined in BFS weren’t visible in Odoo, limiting financial tracking.

Lack of Real-Time Sync:

- Customer details, asset registration, and loan data lacked consistency.

Limited CRM Capabilities:

- Absence of an in-built loan simulator restricted advisors from generating real-time loan insights.

Solution Implemented

- Leads captured in Odoo CRM automatically flow to BFS via middleware.

- Once opportunities are marked “Won,” BFS validates and approves loans.

- Approved records sync back to Odoo, locking critical fields as read-only for compliance.

- Customer updates in Odoo (address, KYC, entity type) trigger API calls to BFS.

- Middleware validates data and ensures seamless mapping for natural persons, legal entities, and joint holders.

Lead-to-Loan Automation

Real-Time Customer Data Sync

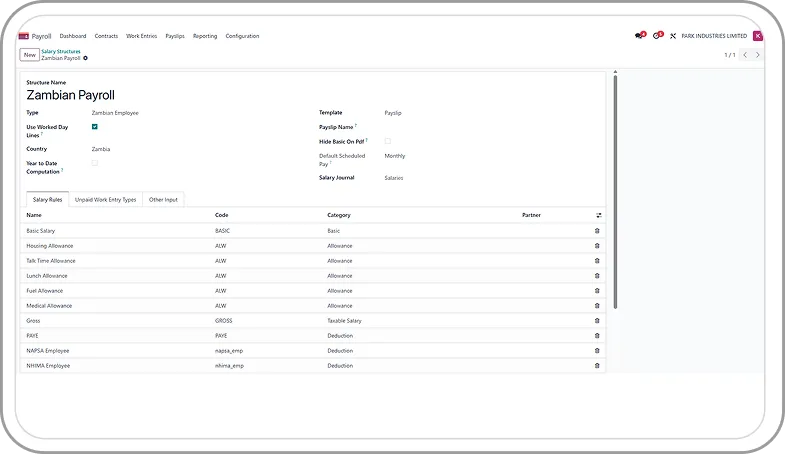

Techvoot designed a three-tier integration architecture using Odoo Middleware BFS to automate critical banking workflows while maintaining BFS as the single source of truth. Our solution ensured secure, bi-directional data synchronization for leads, customers, loans, budgets, and assets, all in real time.

- Budgets created in BFS are visible in Odoo.

- When a purchase order is created, users link it to an existing budget, automatically deducting proportional amounts in both systems.

- Each purchase order in Odoo generates an asset entry in BFS.

- BFS maintains the complete lifecycle, depreciation, and financial tracking while Odoo serves as the operational front-end.

- A Loan Simulator embedded in Odoo CRM allows staff to input loan parameters and fetch real-time repayment schedules from BFS APIs.

- Enables accurate, on-the-spot loan calculations and enhances customer confidence.

Budget Management Integration

Automated Asset Registration

Loan Simulator Development

Technical Safeguards

Secure Token-Based APIs for authentication and encryption.

Centralized Logging in middleware for validation and error traceability.

Data Integrity Enforcement Read-only fields in Odoo post-approval to prevent overrides.

Scalable Modular Design Easily extendable to include future modules like compliance, risk scoring, and analytics.

Transforming Banking Operations with Odoo Bank Smart

Delivering real-time visibility, smarter automation, and seamless process control across financial workflows. With Odoo Bank Smart, our client modernized multi-branch operations, automated compliance-heavy processes, and unlocked faster decision-making through unified financial insights all built on a scalable Odoo architecture.

Talk to Our Experts TodayLooking Ahead

Looking Ahead

With this successful integration, the client now operates a fully automated digital banking ecosystem powered by Odoo and BFS.

This project demonstrates how Techvoot Solutions delivers enterprise-grade banking automation and Odoo integrations that accelerate digital transformation while ensuring regulatory compliance and operational excellence.

- AI-driven risk scoring and compliance monitoring

- Predictive analytics for loan performance

- Automated customer engagement dashboards

- Advanced loan lifecycle insights and alerts

The foundation enables future enhancements such as:

Results & Impact

Business Impact

- 70% faster loan approval turnaround time.

- Zero duplication in customer and loan records across systems.

- Budget control visibility directly within Odoo’s finance workflows.

- Enhanced customer experience via real time loan simulations & transparency.

- Improved compliance & audit readiness through automated locking and traceability.

Technical Impact

- Real-time synchronization of multi-entity data between Odoo and BFS.

- Secure, modular API gateway allowing future feature expansion.

- Middleware validation prevents data mismatch or transaction failures.

- Scalable microservice architecture for easy deployment and monitoring.

// We are here to help you

Trusting in Our Expertise

- 30 Hours Risk Free Trial.

- Direct Communication With Developer.

- On-time Project Delivery Assurity.

- Assign Dedicated PM.

- Get Daily Update & Weekly Live Demo.

- Dedicated team 100% focused on your product.

- Sign NDA for Security & Confidentiality.